Cass Freight Index August 2025: Navigating Declining Shipments and Rising Costs

- Kelsea Ansfield

- Sep 17, 2025

- 4 min read

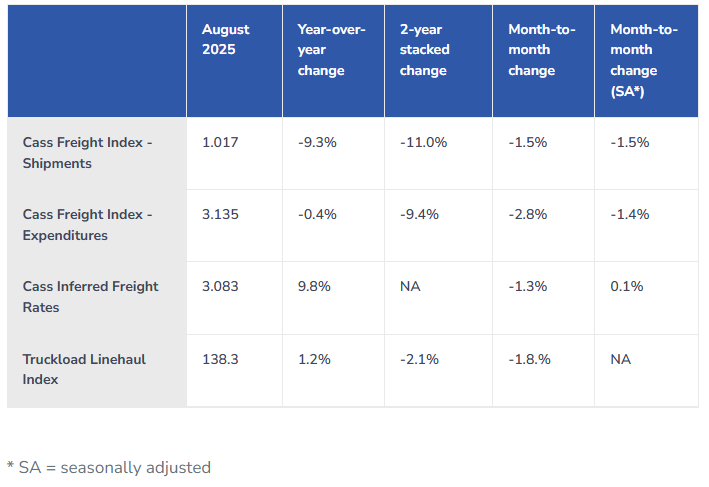

At Gain Consulting, we’re dedicated to helping businesses stay ahead in the dynamic world of logistics by leveraging key industry insights. The Cass Transportation Indexes, a trusted measure of North American freight activity, provide a critical snapshot of market trends. The August 2025 report, based on preliminary data and forecasts from Cass Information Systems, reveals a freight market grappling with declining shipment volumes and modestly rising rates.

As of September 17, 2025, these trends signal economic caution and highlight the need for strategic logistics planning. Here’s what the August 2025 Cass Freight Index means for your business and how Gain Consulting can help you adapt.

Decoding the Cass Freight Index

The Cass Freight Index, compiled monthly by Cass Information Systems, tracks freight shipments and expenditures across North America, covering all domestic transport modes, with truckload (TL) making up over 50% and less-than-truckload (LTL) about 25%. It includes two primary components:

Shipments Index: Measures the volume of freight shipments, reflecting demand in sectors like retail and manufacturing.

Expenditures Index: Tracks total freight spending, incorporating both contract and spot market rates.

The Cass Truckload Linehaul Index complements these by focusing on per-mile truckload pricing trends. Released around the 13th of each month, the August 2025 data offers a fresh look at summer freight activity and its economic implications.

August 2025 Cass Freight Index Highlights

Preliminary data for August 2025, building on trends from prior months and Cass’s 2025 forecasts, paints a challenging picture:

Shipment Volumes Down: The Shipments Index is projected to decline approximately 8% year-over-year (y/y), consistent with seasonal patterns but reflecting ongoing weakness in consumer demand. This follows annual declines of 5.5% in 2023 and 4.1% in 2024, with 2025 expected to see another yearly drop. Recent import surges have slightly cushioned this decline, but volumes remain soft.

Expenditures and Rates Rising Modestly: Freight expenditures are stabilizing after a 7% drop in 2024, with inferred freight rates (expenditures divided by shipments) expected to rise y/y in August due to seasonal factors. The Cass Truckload Linehaul Index, which tracks per-mile TL pricing, increased 2.4% y/y in July (from 1.9% in June) despite a 0.6% month-over-month (m/m) dip. For 2025, rates are on track for a small net gain, driven by shifts toward higher-cost TL shipments and tighter capacity.

These trends suggest a market where reduced demand is putting pressure on volumes, while rates are inching up due to capacity constraints and shipment mix changes. Economic signals, like declining corrugated cardboard sales, reinforce concerns about a potential slowdown.

What This Means for Your Business

The August 2025 Cass Freight Index has significant implications for logistics-dependent businesses:

Lower Freight Volumes: An 8% y/y drop in shipments could lead to excess carrier capacity, increasing competition for loads and potentially softening spot rates. Businesses may need to adjust inventory and shipping strategies to align with reduced demand.

Rising Costs: Modest rate increases, combined with upcoming carrier hikes (e.g., FedEx’s 5.9%–6.9% rate increase for 2026), could squeeze margins, especially for high-volume shippers.

Economic Uncertainty: Softening shipment volumes align with broader economic caution, urging businesses to prioritize efficiency and cost control.

Strategic Opportunities: This environment favors proactive measures like optimizing carrier selection, renegotiating contracts, and leveraging data to streamline operations.

How Gain Consulting Can Support You

Gain Consulting specializes in turning market challenges into opportunities through tailored logistics solutions. Here’s how we can help you navigate the trends highlighted by the August 2025 Cass Freight Index:

Cost-Effective Carrier Strategies: Our team excels at securing competitive rates and diversifying carrier options to mitigate rising costs. We can help you explore alternatives to major carriers, such as regional players like OnTrac, to optimize your shipping budget.

Data-Driven Insights: Using advanced analytics, we analyze your shipping patterns to identify cost-saving opportunities and align with market trends like those in the Cass Index. Our experts can forecast demand shifts and recommend adjustments to keep you ahead.

Streamlined Operations: From invoice accuracy to dispute resolution, we ensure your logistics processes are efficient, reducing unnecessary expenses in a tight market.

Customized Solutions: Whether you’re managing truckload, LTL, or parcel shipments, our team designs strategies to balance cost, speed, and reliability, tailored to your business needs.

Preparing for a Shifting Freight Market

The August 2025 Cass Freight Index underscores the need for agility in logistics planning. Declining shipments and rising rates signal a market in flux, but with the right approach, businesses can thrive. At Gain Consulting, we’re committed to helping you optimize your supply chain, reduce costs, and seize opportunities in this challenging environment.

As we await the full September report, now is the time to reassess your logistics strategy. Let Gain Consulting guide you through these market shifts with expertise and actionable solutions.

Contact us today to learn how we can help your business navigate declining volumes and rising costs. Visit our website or reach out to our sales team to discuss tailored logistics strategies that drive results.

Sources: Cass Information Systems, "Cass Transportation Index Report | July 2025" (for August forecasts); FRED Economic Data, Cass Freight Index: Shipments (updated August 14, 2025).

Comments