July 2025 Truck Tonnage Index: Steady but Stagnant Freight Market

- Kelsea Ansfield

- Aug 20, 2025

- 3 min read

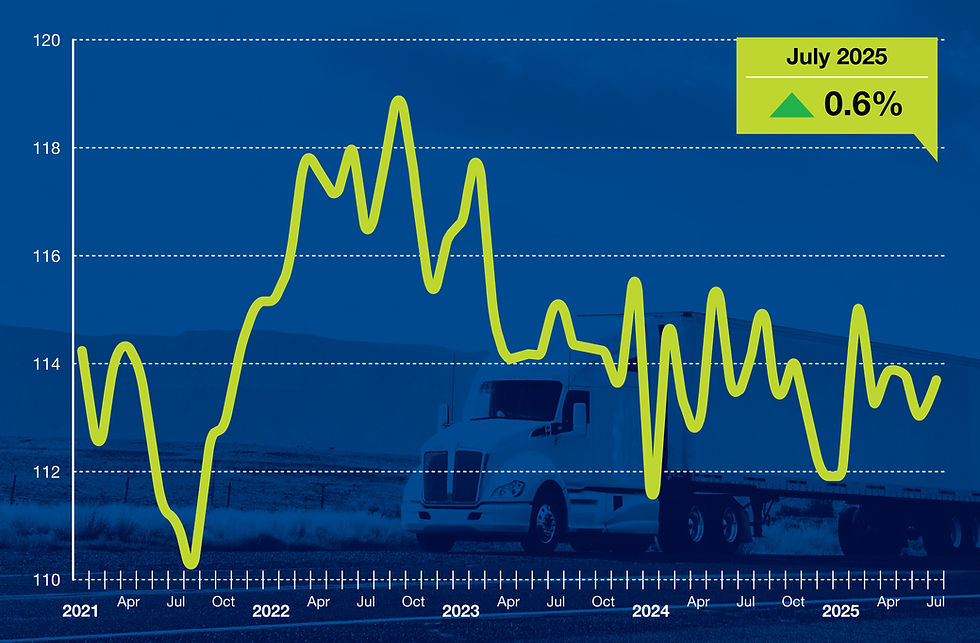

The American Trucking Associations’ (ATA) For-Hire Truck Tonnage Index for July 2025, released on August 20, 2025, shows a modest uptick in trucking activity, with a 0.6% increase from June’s reading of 113.0 to 113.7 (2015=100, seasonally adjusted). However, the freight market remains largely stagnant, with activity hovering in a tight range since March. At Gain Consulting, we’re analyzing the implications of this data to help shippers and logistics providers navigate a market poised for potential recovery.

Key Insights from the July 2025 Truck Tonnage Index

The ATA’s Truck Tonnage Index, a key barometer of the U.S. economy representing 72.7% of domestic freight tonnage, indicates a slight rebound after a 0.7% decline in June. Despite this sequential gain, the index slipped 0.1% year-over-year from July 2024 and remains flat year-to-date compared to 2024. The not seasonally adjusted index rose 1.9% from 114.6 in June to 116.8 in July, reflecting raw tonnage changes.

ATA Chief Economist Bob Costello noted, “July truck tonnage increased sequentially, but did not erase the 0.7% decline in June. Since March, truck tonnage has been in a tight range. The good news is truck freight volumes haven’t fallen much over that period, but we are not seeing many increases either.” Mixed economic drivers in July—rising housing starts and retail sales, contrasted with flat to declining manufacturing output—contribute to this stagnation.

Economic Context

The trucking sector’s performance aligns with broader economic trends:

Housing Starts: Up 4.6% in June, supporting construction-related freight.

Retail Sales: Positive growth, boosting consumer goods transport.

Manufacturing Output: Flat to down, reflecting industrial softness, as seen in the Institute for Supply Management Manufacturing Index at 49 (indicating contraction).

Tariff Impacts: Ongoing uncertainties, with tariffs ranging from 15% (EU, Japan, South Korea) to 50% (Brazil), continue to disrupt freight demand, as noted in the July 2025 Cass Freight Index, which reported a 6.9% year-over-year shipment decline.

These factors, combined with the June 2025 Freight Transportation Services Index (TSI) showing a 0.4% month-over-month drop, highlight a freight market grappling with volatility but showing resilience.

Implications for Shippers and 3PLs

The modest tonnage increase and persistent flatness suggest a freight market in a holding pattern, with carriers and brokers anticipating a recovery within six months, as reported by DC Velocity on August 8, 2025. Rising freight rates, evidenced by the 7.1% year-over-year increase in the Producer Price Index (PPI) for long-distance LTL trucking in July 2025, add cost pressures for shippers. Key implications include:

Stable but Limited Growth: The flat tonnage trend indicates stable demand but limited upside, requiring shippers to optimize operations to manage costs.

Rising Costs: Increasing rates, as seen in the PPI and ArcBest’s 5.9% LTL rate hike in August 2025, necessitate strategic carrier negotiations and freight consolidation.

Capacity Opportunities: With manufacturing job losses (37,000 over three months) and reduced vehicle production, capacity may tighten in 2026, driving freight back to the for-hire market.

Strategic Recommendations

To navigate the stagnant freight market and prepare for a potential rebound, Gain Consulting recommends the following:

Optimize Load Planning: Consolidate shipments to maximize truckload efficiency and explore intermodal options, such as Union Pacific’s new Inland Empire-to-Chicago service launching September 3, 2025, to reduce costs.

Leverage Data Insights: Use the Bureau of Transportation Statistics’ freight mobility data, based on GPS from over 350,000 trucks, to optimize routing and minimize transit times.

Secure Carrier Capacity: Lock in contracts now to ensure access to capacity and favorable rates as the market tightens, especially with anticipated recovery in early 2026.

Mitigate Rate Increases: Audit freight classifications under the updated National Motor Freight Classification (NMFC) system to avoid cost spikes, particularly with FedEx Freight’s delayed adoption until December 1, 2025.

How Gain Consulting Can Help

At Gain Consulting, we specialize in helping businesses thrive in challenging freight markets. Our team can analyze your shipping data, negotiate carrier contracts, and integrate advanced data tools to drive efficiency and savings. Whether you’re managing rising LTL rates, exploring intermodal solutions, or preparing for a market recovery, we’re here to deliver tailored strategies that position you for success.

Looking Ahead

The July 2025 ATA Truck Tonnage Index reflects a freight market that’s holding steady but struggling to gain momentum. With economic indicators showing mixed signals and a recovery anticipated within six months, proactive planning is essential.

Contact Gain Consulting today to learn how we can help you optimize your logistics strategy, reduce costs, and capitalize on emerging opportunities in the freight market.

Source: American Trucking Associations, For-Hire Truck Tonnage Index, August 20, 2025; additional insights from BTS, Cass Information Systems, Logistics Management, DC Velocity, and CCJ, August 2025

Comments