Cass Freight Index Update: November 2025 Data Signals Mixed Signals Amid Seasonal and Regulatory Shifts

- Kelsea Ansfield

- 1 day ago

- 3 min read

The latest Cass Freight Index report for November 2025 offers a snapshot of a freight market navigating post-tariff adjustments, seasonal holiday dynamics, and emerging weather impacts. While shipments showed modest recovery, expenditures remained subdued, reflecting ongoing pressures from lower volumes and shifting modal mixes.

Shipments Rebound Slightly, But Annual Declines Persist

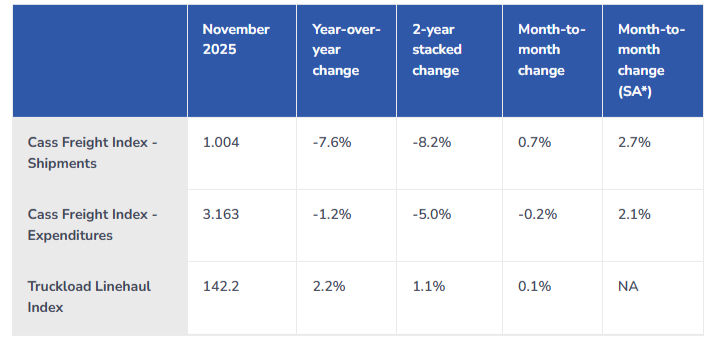

The shipments component of the Cass Freight Index rose 0.7% month-over-month (m/m) in November, or 2.7% in seasonally adjusted (SA) terms. This reversed the 2.1% SA decline seen in October.

However, year-over-year (y/y) trends remain challenging. Following a 7.6% y/y drop in October—worse than the -5.8% year-to-date (YTD) average—the index is on pace for an approximate 6% decline in 2025.

Truckload volumes, which had briefly strengthened in Q3 ahead of the October 5 import tariff deadline, softened again in Q4 as pre-tariff inventories are drawn down. Resilient early holiday consumer spending hints at potential pent-up demand, though ongoing tariffs are expected to elevate prices and erode affordability into 2026.

Looking ahead, normal seasonal patterns suggest a 4% y/y decline in shipments for December.

Expenditures Flatline as Rates Face Mixed Pressures

The expenditures component, tracking total freight spend, dipped 0.2% m/m in November and was 1.2% below year-ago levels—following a minor 0.2% y/y slip in October.

Recent flattish results stem from a combination of reduced shipments and elevated rates. Inferred rates rose approximately 6.8% y/y, driven largely by modal shifts toward more truckload (TL) and away from less-than-truckload (LTL)—a pattern consistent with recent months.

In SA terms, expenditures gained 2.1% m/m, lagging the 2.7% shipments increase, implying a slight rate pullback.

After surging 38% in 2021 and 23% in 2022, expenditures plummeted 19% in 2023 and 11% in 2024. For 2025, a decline of under 1% is likely, with potential to end flat if December proves strong.

Truckload Linehaul Rates Edge Higher

The Cass Truckload Linehaul Index increased 0.1% m/m in November, following a 1.1% rise in October. The y/y gain slowed to 2.2% from 3.0% in October.

Stronger-than-expected holiday spending, combined with weather-related capacity constraints, is temporarily tilting market balance toward carriers in December.

This index dropped 10% in 2023 and 3.4% in 2024, with a projected 1.7% increase for 2025.

Freight Outlook: Weather and Regulations in Focus

Frigid December weather, with three storms already recorded, aligns with the ongoing La Niña pattern. This is likely to deliver more storms across the northern U.S. and Canada while keeping the South drier—tightening spot capacity during a peak seasonal demand period and pushing spot rates higher in recent weeks.

Though weather effects are often short-lived, this stormy winter is contributing to capacity tightening and supporting a near-term upward revision in the freight rate outlook.

On the regulatory front, recent updates from the Environmental Protection Agency (EPA), relayed through the American Trucking Associations (ATA), indicate that the EPA'27 low-NOx regulations will partially proceed in 2027. Technology improvements remain in place, but costly warranty extensions and useful life requirements have been removed.

With investment capital limited amid historically low for-hire truckload margins, this adjustment offers some incentive for 2026 prebuys among fleets with financial flexibility. Private fleets, still trimming excess capacity from 2023-2024 overbuying, are unlikely to drive a massive prebuy wave. Nonetheless, it provides moderate downside protection for the 2026 rate outlook.

Key Takeaways for Shippers and Carriers

November's data underscores a freight market in transition: modest sequential gains against persistent annual weakness. Holiday resilience and weather disruptions offer short-term support for rates, but tariffs and affordability challenges loom larger for 2026.

At Gain Consulting, we closely monitor these indices to help clients optimize transportation strategies. Whether navigating rate negotiations, modal shifts, or regulatory impacts, our expertise can guide informed decisions in this evolving landscape.

For personalized insights or to discuss how these trends affect your operations, contact Gain Consulting today.

Data sourced from the Cass Freight Index Report and related analyses.

Comments